Slowdown Continues for Small Businesses

Table of Contents

The past number of months have found economists and regulators fret about the impression of continued wage progress on inflation and employer outlook. Soon after considerable fee hikes from the Fed, indicators are beginning to little by little revert.

Our facts from the US and Canada demonstrates a new 12 months ebb in financial exercise at smaller companies.

Previous variations of this report have reviewed ongoing problem in excess of the tempo of wage development and reduced jobless statements primary the Fed to retain its sturdy tactic to amount hikes. As alerts of an overall economy running incredibly hot start off to abate, Homebase seeks to fully grasp how the broader economic atmosphere is affecting small organizations and their staff members through the get started of 2023 by examining behavioral info from additional than two million workers operating at a lot more than one particular hundred thousand SMBs.

Summary of conclusions: Homebase superior-frequency timesheet data indicate continued slowdown in hrs labored and workers working, throughout most industries and key metro places

- January has viewed a sluggish commence with a continuing downward trajectory while 2022 observed progress in hours worked by means of Q1, 2023 ranges for personnel working and several hours worked are 4-5 percentage factors down below their January 2022 marks.

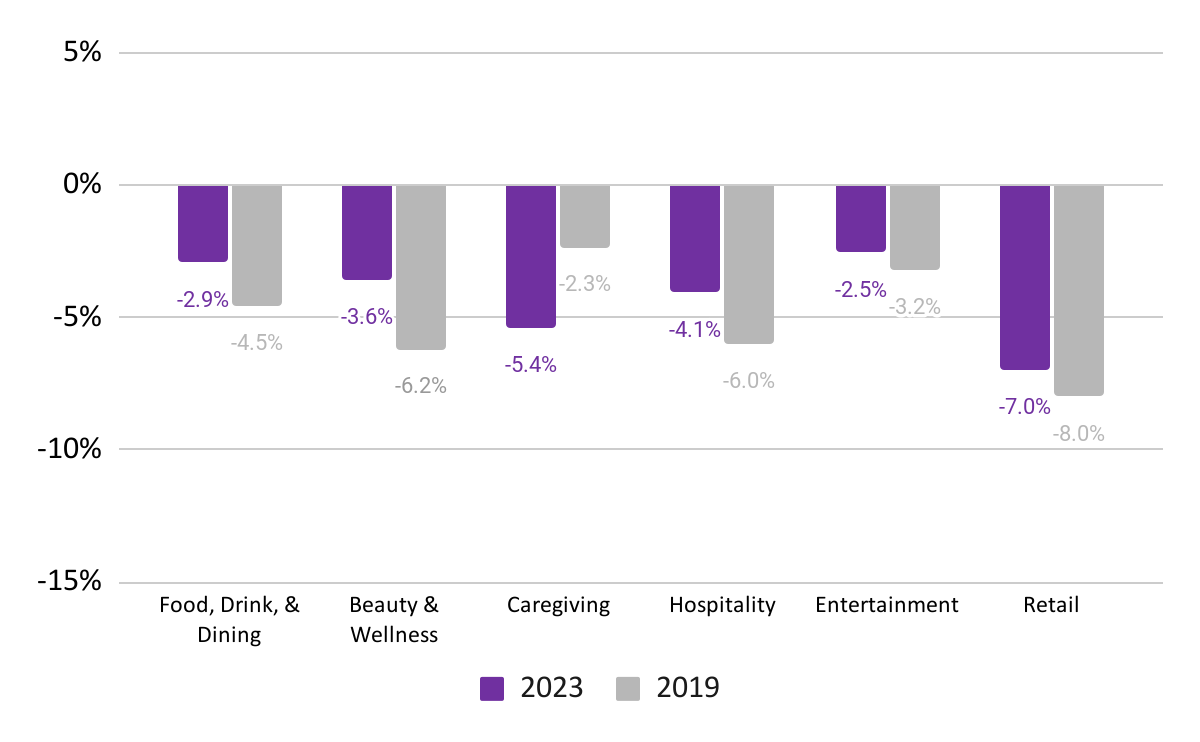

- Article-holiday getaway declines across industries are softer than what we noticed pre-COVID with the exception of caregiving workforce participation in leisure has rebounded the most noticeably from holiday lows, only 2.3% under mid-December degrees.

- Several hours worked across metro spots keep on being somewhat underneath their pre-holiday stages, a development related to prior many years nevertheless, January 2023 levels have remained rather frequent by means of the month, alternatively than mounting as they did in 2021 and 2022.

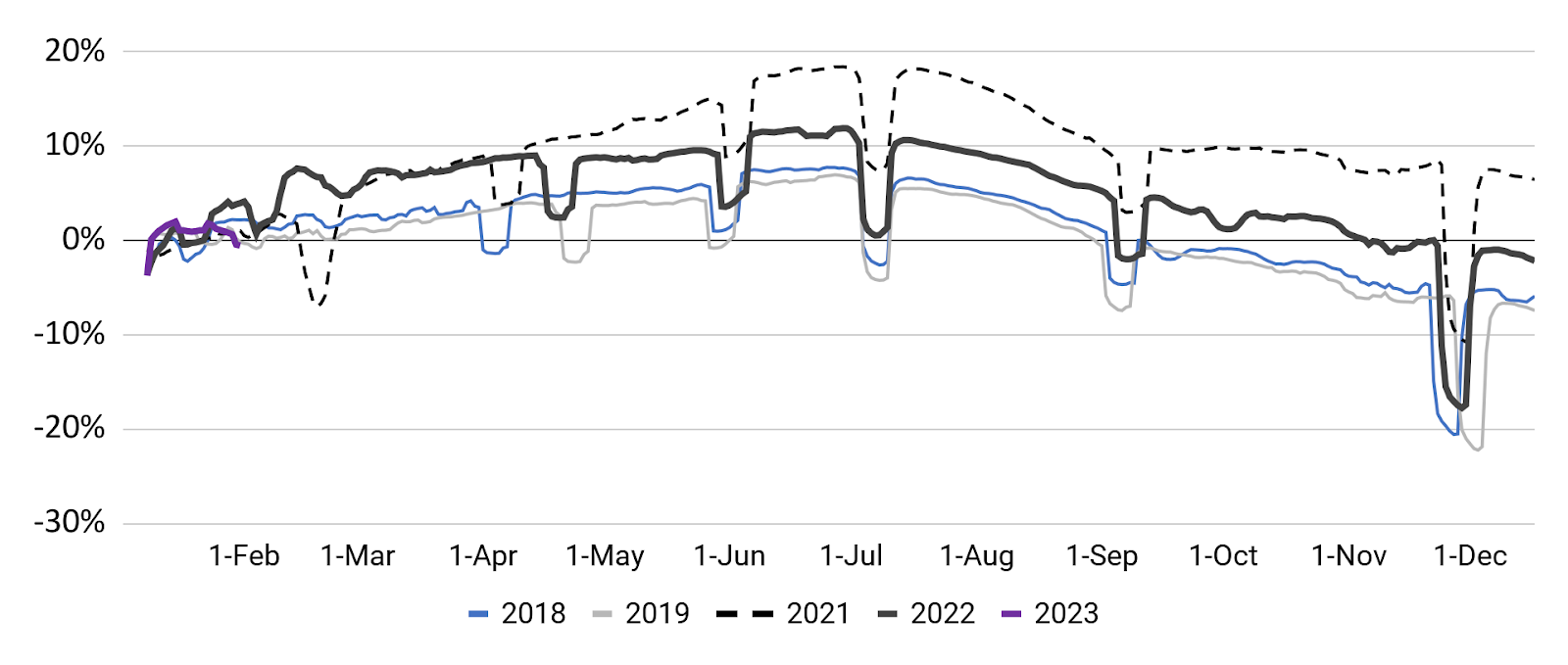

January has noticed a sluggish commence with a continuing downward trajectory whilst 2022 noticed development in hrs labored by Q1, 2023 stages for workers operating and hours worked are 4-5 percentage points down below their January 2022 marks.

Personnel doing the job

(Rolling 7-day normal relative to Jan. of documented calendar year)

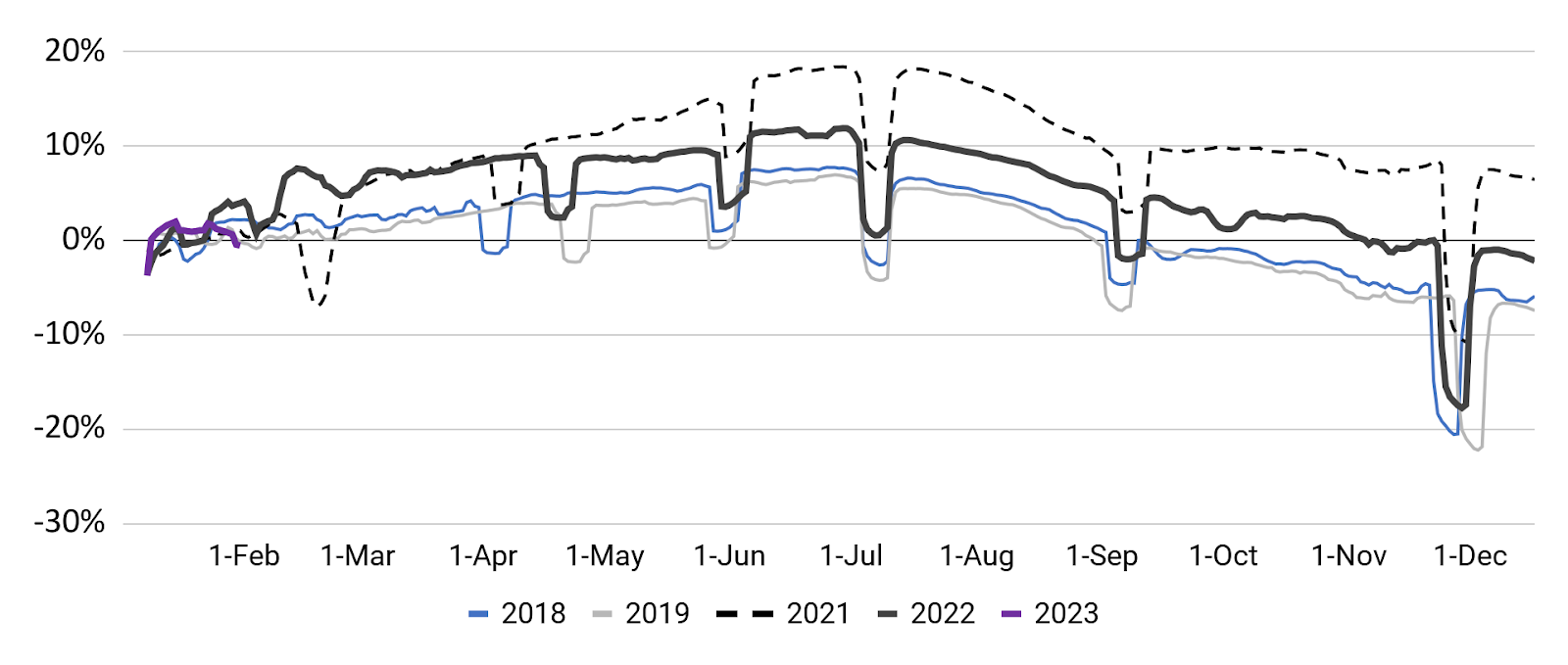

Primary Road Wellness Metrics1

(Rolling 7-working day typical relative to Jan. 2022)

1. Some sizeable dips thanks to key U.S. holidays. Pronounced dip in mid-February 2021 coincides with the period of time which include the Texas energy disaster and extreme weather conditions in the Midwest. Dip in late September coincides with Hurricane Ian. Supply: Homebase details.

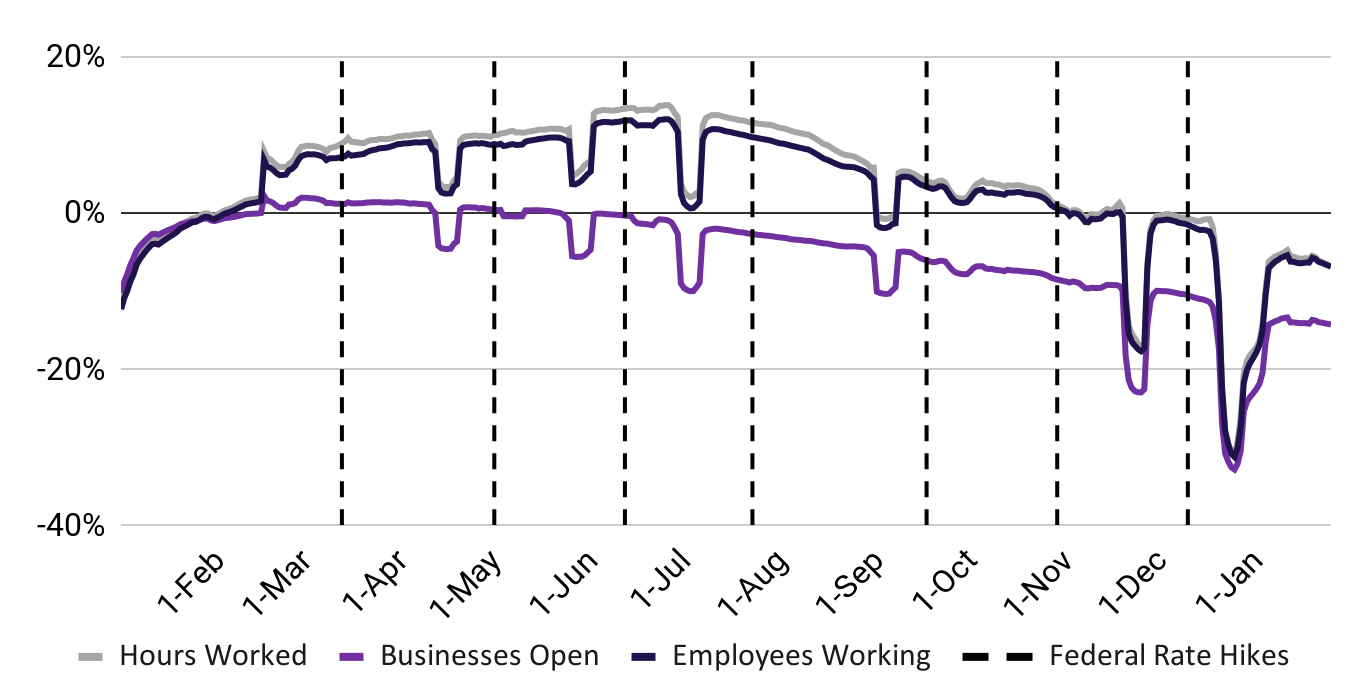

Publish-holiday declines across industries are softer than what we saw pre-COVID with the exception of caregiving workforce participation in entertainment has rebounded the most noticeably from holiday lows, only 2.3% underneath mid-December levels.

Per cent modify in staff members functioning

(In contrast to January 2022 baseline using 7-day rolling common)1

Per cent change in workers doing work

(Mid-January vs. mid-December of prior year, utilizing Jan. ‘22 and Jan. ‘19 baselines)1

1. January 15-21 vs. December 11-17 (2022/2023) and January 12-18 vs. December 8-14 (2019/2020). Pronounced dips usually coincide with big US Vacations. Resource: Homebase info

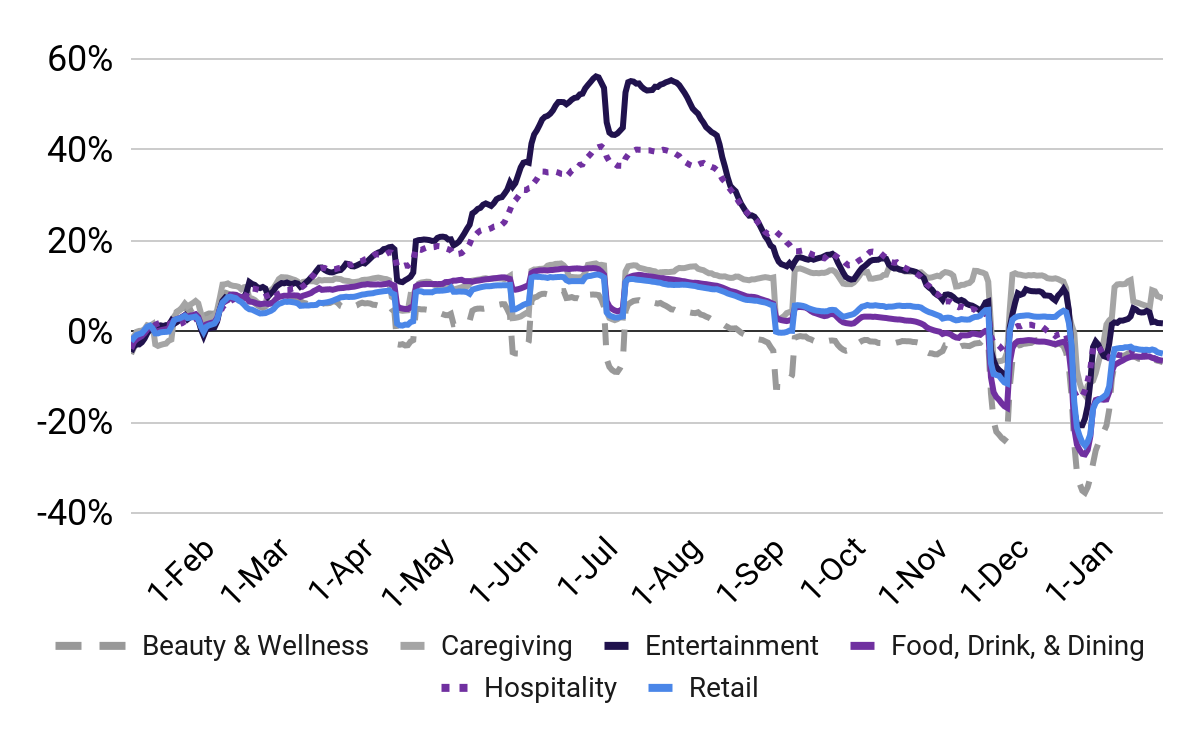

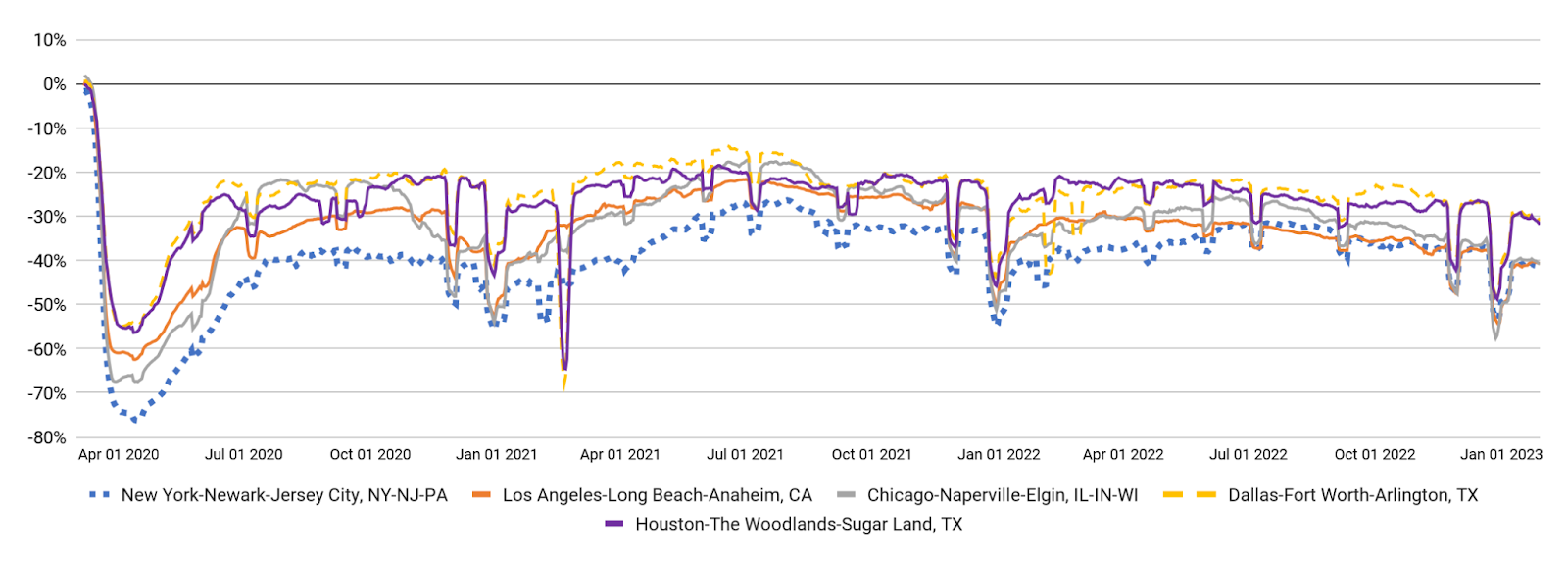

Hrs worked throughout metro areas stay a little bit down below their pre-vacation ranges, a trend similar to prior several years even so, January 2023 ranges have remained comparatively constant through the thirty day period, instead than growing as they did in 2021 and 2022.

Hours labored

(Rolling 7-day common relative to Jan. 2020 (pre-Covid))

1. Some major dips thanks to main U.S. holiday seasons. Pronounced dip in mid-February 2021 coincides with the period of time like the Texas electric power disaster and intense temperature in the Midwest. Resource: Homebase knowledge.

For a PDF of our January report, make sure you pay a visit to this PDF if you pick to use this data for study or reporting applications, you should cite Homebase.

Hyperlink to PDF of: January 2023 Homebase Major Street Overall health Report