Selective Insurance Stock: Select For Portfolio Insurance (NASDAQ:SIGI)

Table of Contents

atakan/iStock via Getty Images

Introduction

Insurance stocks have beaten the S&P 500 so far this year. In the property and casualty branch, Selective Insurance (NASDAQ:SIGI) looks very well positioned to outperform its peers. Fundamentally, it is demonstrating superior pricing resiliency compared to its peers in the commercial lines segment, and rapidly taking steps to improve the growth and margin profile mix in the personal insurance segment. The stock is available at a discount relative to the historical premiums it has traded against the industry. From a technical analysis standpoint, there are bullish signs from an absolute perspective, relative to the S&P 500 and relative to its industry peers as captured by Invesco’s Property & Casualty Insurance ETF (KBWP).

Key Note

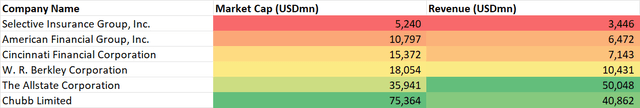

Unless otherwise specified, the industry peer set includes Selective Insurance, American Financial Group (AFG), Cincinnati Financial Corporation (CINF), W. R. Berkley (WRB), The Allstate Corporation (ALL) and Chubb (CB):

Insurance Peer Set (Own Analysis)

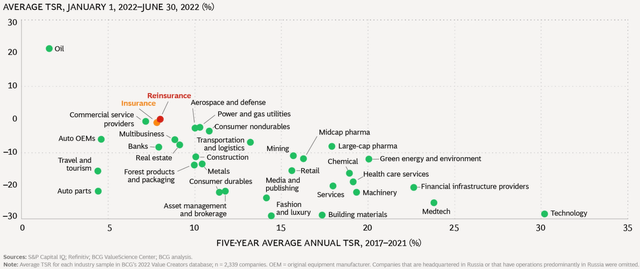

Insurance Stocks Are Good Portfolio Insurance

In my last stock analysis article on Reinsurance Group of America (RGA), I noted how reinsurance has been the 2nd best performer in the market this year after oil. Insurance also belongs in that league in 3rd or 4th place:

Hence, insurance stocks seemed like a great way to insure the capital value of my portfolio in the current bear market. After studying the opportunities in this sector, although I liked and bought other names as well such as Hartford Financial (HIG) and Prudential Financial (PRU), I thought Selective Insurance was the most compelling buy.

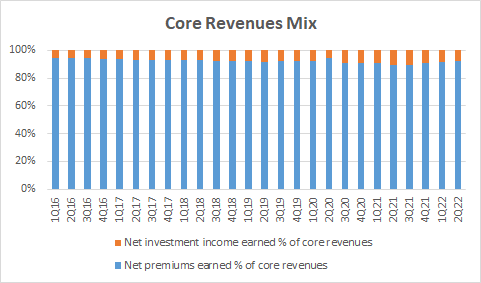

About the Business

Selective Insurance is a property casualty insurance company operating in the United States. It makes more than 90% of its revenues from earned premiums and the remainder from investment income:

Core Revenues Mix (Company Filings, Own Analysis)

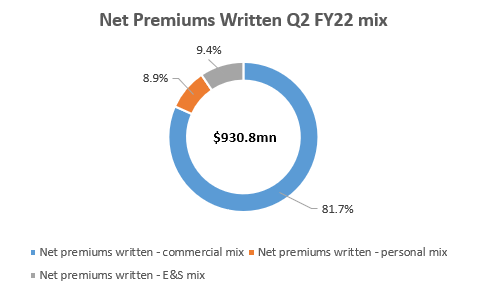

In Q2 FY22, the company wrote $931mn in net premiums. 82% was in commercial property and casualty insurance, 9% in personal lines, and the remainder in surplus and surplus lines:

Net Premiums Written Q2 FY22 Mix (Company Filings, Own Analysis)

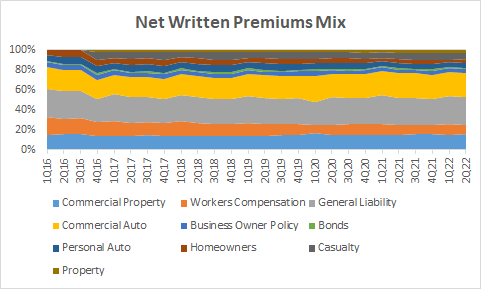

General liability, commercial auto, commercial property, and worker’s compensation insurance lines make up more than 75% of the business mix:

Net Premiums Written Mix (Company Filings, Own Analysis)

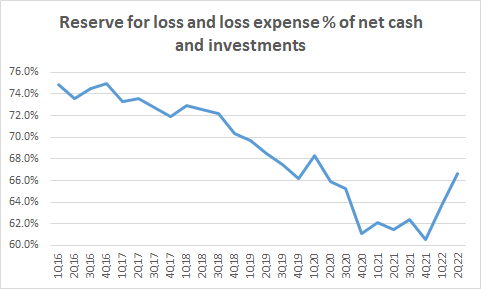

The company has healthy liquidity to fund its reserves position to fund claim liabilities. It can fund all its reserves for losses and still have 33% of its net cash and investments left over:

Loss Reserves Analysis (Company Filings, Own Analysis)

To succeed in the insurance business, one needs to understand the customer profiles and the risks in granular detail in order to conduct effective price discrimination, thus maximizing producer surplus.

Selective Insurance does this by delegating key commercial decisions across 6 regional territories, each empowered to determine its policy scope, pricing, reserving, and profitability decisions. This has allowed the company to adapt to the demand environment more agilely, reducing volatility in business operations. For example, based on my analysis of company filings, the standard deviation of Selective Insurance’s combined ratio over the past 6 years is 2.5% compared to 2.8% of the industry.

Incrementally, Selective Insurance is realigning its personal insurance segment towards the mass-affluent market. As many personal customers in this segment may also be small business owners, this move seeks to reduce dependence on low-price based competition and leverages the company’s strengths in coverage depth by opening up cross-selling opportunities into commercial lines. Geographic expansion in the commercial lines business is another key growth driver; the company entered Vermont in Q2 FY22 and is on track to expand into Alabama and Idaho in the coming months.

Why Select Selective Insurance?

I am bullish on Selective Insurance for three main reasons based on my opinion:

- Selective Insurance will continue resilient performance relative to the industry

- Leading indicators show great traction in the new personal lines insurance strategy

- Selective Insurance is returning to a valuation premium relative to the industry

Here’s my argument for each of these three reasons:

Selective Insurance will continue resilient performance relative to the industry

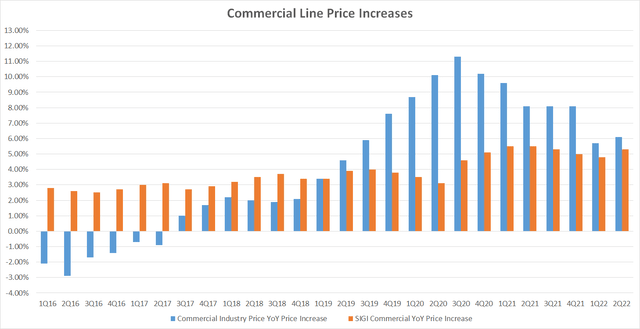

The commercial lines industry is currently seeing a sharp deceleration in pricing. Considering how inflation is at 8.3% in the US, prices have been falling in real terms. However, Selective Insurance has been very resilient and is not seeing sharp pricing deceleration. On the contrary, Selective Insurance has been able to accelerate price increases over recent quarters:

US Commercial Insurance Pricing (Property/Casualty Market Survey – The Council of Insurance Agents and Brokers)

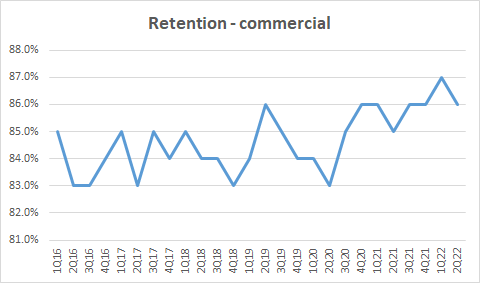

Customer retention has also consistently improved over recent quarters to sit at 86% in 2Q FY22. The industry average is 84%. This is an impressive result, given Selective Insurance’s smaller scale and bargaining power with distributors. Noteworthily, CEO John Joseph Marchioni expressed confidence in the company’s continued pricing ability in the Q2 FY22 earnings call:

I feel like we do a really good job of that [passing on pricing in an inflationary environment]

Commercial Insurance Retention (Company Filings, Own Analysis)

Management attributes the strong performance in pricing and retention to the successful execution of their granularity-focused regional office model.

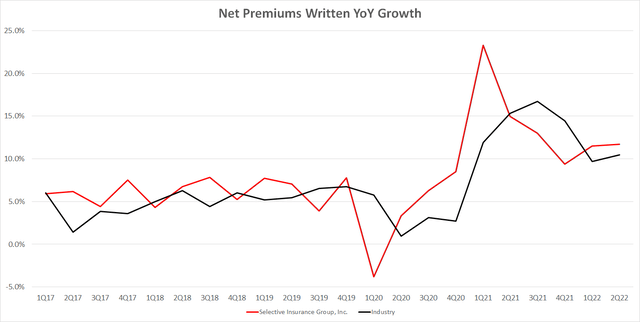

These effects have contributed to faster growth in net premiums written relative to the industry:

Net Premiums Written YoY Growth (Company Filings, Own Analysis)

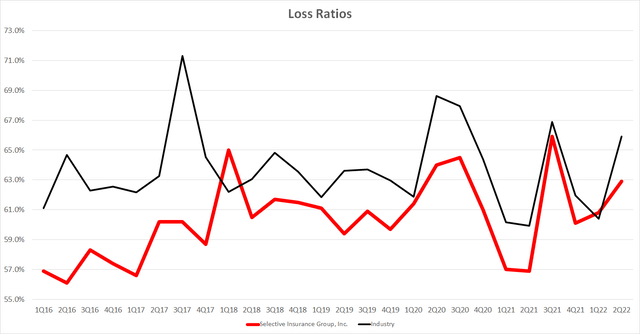

Selective Insurance’s region-focused decision-making model translates to superior operational metrics as well as seen by lower loss ratios relative to the industry:

Loss Ratios (Company Filings, Own Analysis)

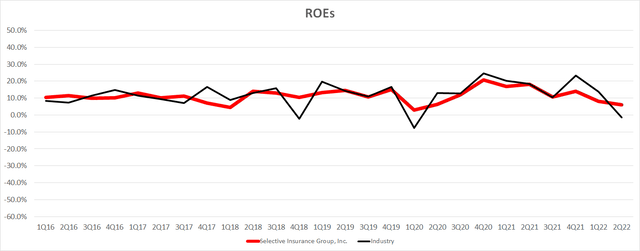

From an ROE perspective, Selective Insurance has a track record of resiliency; the 6-year standard deviation of its ROE is 4.1%; the lowest amongst any of the peers and hence the industry, which has a standard deviation of 7.4%. In Q2 FY22, Selective Insurance’s ROE was 6.0% compared to the industry’s -1.5%, as elevated losses due to inflation depressed returns:

ROEs (Company Filings, Own Analysis)

Overall, industry commentary suggests nominal increases in claims but pressures on pricing to offset these claims. This poses a threat to operating margins. However given its track record, I expect Selective Insurance to continue managing pricing better relative to its peers.

Leading indicators show great traction in the new personal lines insurance strategy

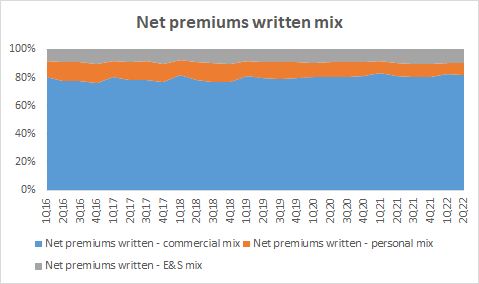

Selective Insurance’s personal insurance lines have been a weaker aspect of its overall portfolio. Over the past 6 years, the personal lines’ combined ratio has averaged 98.6% compared to 92.6%. This has contributed to a drag down in the consolidated combined ratio, which averages 94.2% over the same period.

Over time, the business mix has been shifting favorably toward a higher commercial weight whilst personal insurance has been falling. Over the past 6 years, net premiums written from the personal insurance line have fallen from 13.1% to 8.9% of the overall mix:

Net Written Premiums Mix (Company Filings, Own Analysis)

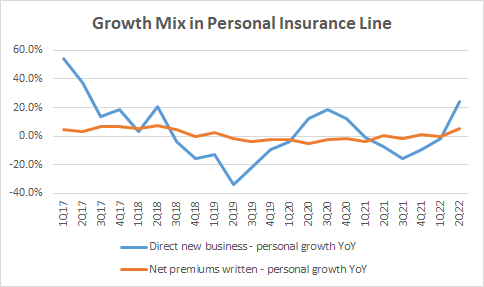

Now, the company is improving its personal insurance portfolio mix by targeting more mass-affluent clients and high-net-worth individuals, which is a higher margin business. The traction in this shift has been very strong. In Q2 FY22, direct new business growth targeting mostly the mass affluent segment was 23.9% YoY; much higher than the overall personal lines growth of 5.1% YoY:

Growth Mix in Personal Insurance Line (Company Filings, Own Analysis)

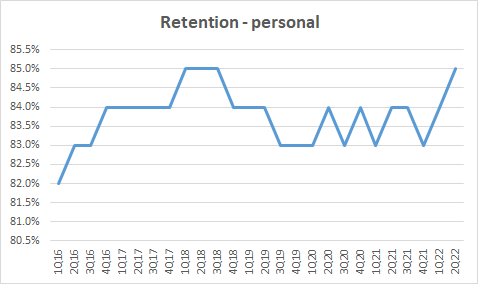

Management commented on solid retention rates in the personal lines segment too and the numbers agree with their claims; retention rates in the personal lines segment has shot up to 85%, suggesting a healthy uptick in the new initiatives:

Retention Rates in Personal Insurance Line (Company Filings, Own Analysis)

Overall, I think this mix shift is a promising indicator of a growth accelerant to the overall personal lines portfolio, and I expect this momentum to continue, improving the segment’s overall revenue and margins profile.

Selective Insurance is returning to a valuation premium relative to the industry

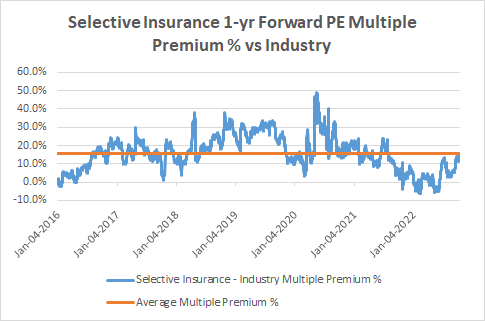

From 2016 till 2020, Selective Insurance has traded at a premium valuation relative to the industry. This may be due to superior pricing performance. As shown earlier, Selective Insurance was consistently clocking in 2-3% of price increases when the rest of the industry was reducing prices.

The 1-yr forward PE multiple valuation premium contracted since 2020 as the industry witnessed much faster pricing acceleration than Selective Insurance. The average 1-yr forward PE multiple premium Selective Insurance has enjoyed since 1st Jan 2016 is 15.8%. Now, this premium stands below this average at 13.7%:

Selective Insurance 1-yr Forward PE Multiple Premium % vs Industry (Capital IQ, Own Analysis)

This industry peer set includes Chubb, American Financial Group, The Allstate Corporation, W. R. Berkley Corporation, The Hanover Insurance Group (THG), Stewart Information Services (STC), Mercury General Corporation (MCY), Cincinnati Financial Corporation, Kemper Corporation (KMPR), The Travelers Companies (TRV), RLI Corp (RLI), Root, Inc (ROOT), The Hartford Financial Services, CNA Financial Corporation (CNA), and United Fire Group (UFCS)

Given the relatively better pricing positioning of Selective Insurance in the commercial lines segment amid price deceleration and the promising traction of a favorable mix shift in the personal lines segment, I believe the stock will re-rate comfortably above the historical valuation premium relative to the industry.

The specifics of what this implies for my fair value assessment is explored further in the following section:

Valuation

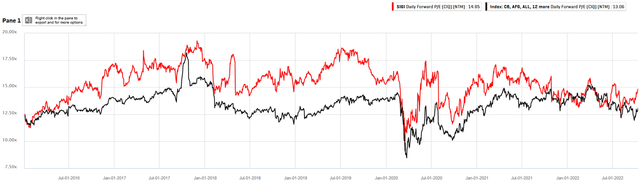

Selective Insurance, Industry PE (Capital IQ, Own Analysis)

Selective Insurance is currently trading at a 1-yr forward PE multiple of 14.85x. The industry is trading at a 1-yr forward PE multiple of 13.06x. As aforementioned, the average premium Selective Insurance has commanded is 15.8%.

To be conservative, I will assume a re-rating back toward the historical average premium 15.8%. although I believe given the tailwinds, the stock will re-rate even higher. This corresponds to a target 1-yr forward PE multiple of 15.12x.

Considering the street’s 1-yr forward EPS forecast of $6.44, this implies a fair value estimate of $97.39/share, corresponding to a 14.7% upside over the current stock price of $84.94. Given the overall bear market conditions, this upside seems very satisfactory.

Technical Analysis

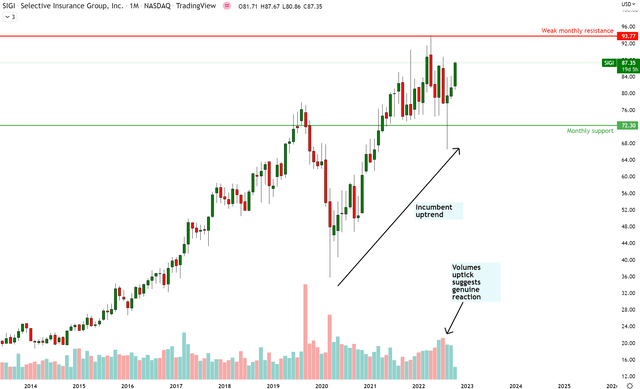

SIGI Technical Analysis (TradingView, Own Analysis)

SIGI has shown a very enthusiastic buy reaction off the monthly support at $72.30. Notice the volumes uptick as well; this suggests a genuine reaction. Currently, price is headed towards the monthly resistance at $93.77. However, this is a weak monthly resistance as price has reacted from that level only once in the midst of an incumbent uptrend.

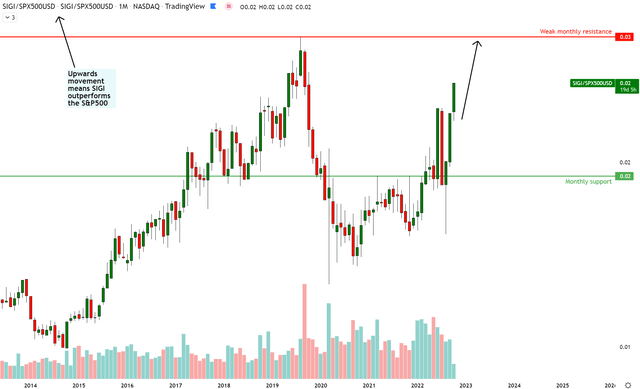

I select my investments and measure my performance based on alpha over the S&P500 (SPX). A good way to directly get a relative alpha view is by looking at the ratio SIGI/SPX500:

SIGI vs S&P 500 Technical Analysis (TradingView, Own Analysis)

The price action again shows a very enthusiastic upwards reaction on the monthly SIGI/SPX500 chart off the monthly support area. I anticipate price to quickly make its way towards the weak monthly resistance and even cross it. Currently, I plan on booking the alpha and rotating back into the S&P500 via a Vanguard ETF (VOO) when this ratio hits the monthly resistance area. However, this plan is subject to change based on how the fundamentals evolve and my view of the price action.

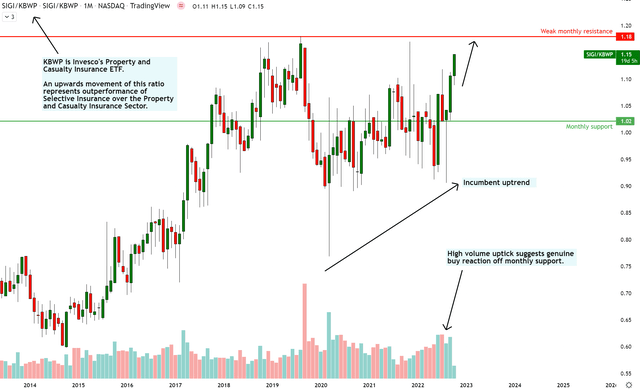

From a fundamental analysis perspective, it’s clear that I expect Selective Insurance to outperform its peers in the property and casualty insurance sector. The good news is, my read of the technicals aligns with this view too:

SIGI vs Invesco’s Property & Casualty Insurance ETF (KBWP) Technical Analysis (TradingView, Own Analysis)

Here, I compare SIGI against Invesco’s Property & Casualty Insurance ETF. The story is similar; strong buyer enthusiasm from monthly support levels with volume uptick that increase the chances of a genuine reaction. The SIGI/KBWP ratio is headed towards weak monthly resistance amid an incumbent uptrend and may very well cross it.

Business Indicators Watchlist

Although SIGI is likely to have resilient commercial line insurance pricing, in absolute terms, the stock can still suffer from top-down headwinds if commercial pricing across the industry suffers. To track this, I am keeping a close eye on the quarterly Property/Casualty Market Surveys published by The Council of Insurance Agents and Brokers.

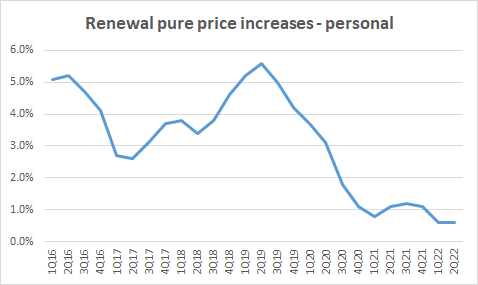

Additionally, I am waiting to see the positive new business and retention momentum in the personal lines insurance segment translate into a healthy uptick in renewal price increases.

Renewal price increases – Personal Insurance Line (Company Filings, Own Analysis)

Management has explained that the original strategic premise for the mix shift towards mass-affluent and high net worth customers was to steer away from price-based competition. Hence, this is a very important indicator to track to judge the execution of this strategic vision.

A Contrarian View Relative to Seeking Alpha’s Quant Ratings

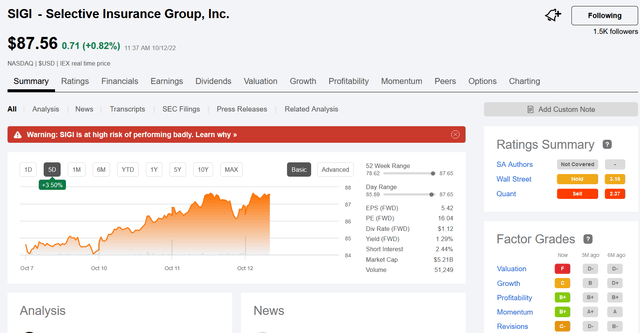

I noticed Selective Insurance does not score well on Seeking Alpha’s Quant Ratings. Indeed, when I searched for the ticker, I got a warning sign for the stock:

Selective Insurance Page on Seeking Alpha (Seeking Alpha)

It looks like this is mostly due to an “F” grade on valuations. I am puzzled by this assessment since according to my analysis, the valuations are quite compelling in this bear market.

Select Selective for Portfolio Insurance

Insurance stocks are already outperforming the market. My last article on RGA was a play on the life insurance sector. I believe Selective Insurance is good to select for portfolio insurance. The stock seems to be in a great hurry upwards, especially relative to the moves the S&P 500 is making. For this reason, I think it would be best not to delay buying if you believe in my thesis for the stock. Or if you have another thesis, please do share your view in the comments below!