PSC Insurance Group Limited’s (ASX:PSI) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

Table of Contents

With its inventory down 6.9% about the earlier a few months, it is straightforward to disregard PSC Insurance coverage Team (ASX:PSI). But if you spend shut notice, you may uncover that its important economical indicators appear quite respectable, which could signify that the stock could likely increase in the long-term supplied how markets generally reward additional resilient extensive-term fundamentals. Specifically, we will be paying out attention to PSC Insurance Group’s ROE currently.

Return on Equity or ROE is a exam of how efficiently a organization is escalating its worth and running investors’ income. In quick, ROE displays the financial gain every single dollar generates with regard to its shareholder investments.

Test out our most recent investigation for PSC Insurance Group

How Is ROE Calculated?

The components for return on equity is:

Return on Equity = Internet Gain (from continuing functions) ÷ Shareholders’ Equity

So, based mostly on the previously mentioned components, the ROE for PSC Coverage Group is:

13% = AU$44m ÷ AU$346m (Centered on the trailing twelve months to December 2021).

The ‘return’ is the annually financial gain. So, this implies that for each and every A$1 of its shareholder’s investments, the business generates a profit of A$.13.

Why Is ROE Essential For Earnings Advancement?

Hence far, we have learned that ROE measures how efficiently a business is building its profits. We now want to assess how a great deal financial gain the enterprise reinvests or “retains” for foreseeable future growth which then gives us an plan about the advancement likely of the enterprise. Assuming all else is equivalent, providers that have both a greater return on equity and bigger earnings retention are ordinarily the ones that have a bigger development charge when compared to firms that do not have the similar features.

PSC Insurance coverage Group’s Earnings Expansion And 13% ROE

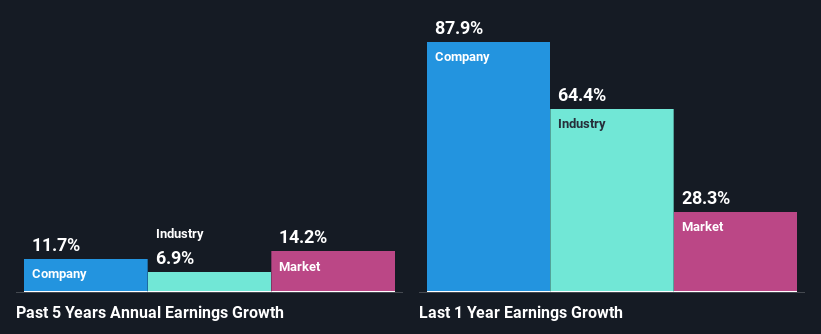

To start off with, PSC Insurance Group’s ROE appears to be satisfactory. On comparing with the ordinary market ROE of 9.9% the company’s ROE appears to be like really outstanding. This unquestionably adds some context to PSC Insurance plan Group’s good 12% internet income expansion found around the previous five yrs.

Next, on comparing with the field internet money expansion, we identified that PSC Insurance coverage Group’s progress is really large when in contrast to the business ordinary advancement of 6.9% in the exact interval, which is fantastic to see.

Earnings development is a huge component in inventory valuation. It is essential for an investor to know regardless of whether the sector has priced in the company’s envisioned earnings development (or decline). This then aids them establish if the inventory is put for a dazzling or bleak potential. Is PSC Insurance plan Team fairly valued as opposed to other organizations? These 3 valuation actions may possibly support you decide.

Is PSC Coverage Group Making Productive Use Of Its Earnings?

PSC Coverage Team has a major 3-year median payout ratio of 93%, that means that it is remaining with only 7.3% to reinvest into its business enterprise. This indicates that the organization has been ready to attain good earnings advancement irrespective of returning most of its earnings to shareholders.

Moreover, PSC Insurance plan Group has paid out dividends about a period of six many years which indicates that the firm is really serious about sharing its profits with shareholders. Upon learning the most recent analysts’ consensus info, we observed that the firm’s upcoming payout ratio is predicted to fall to 60% around the upcoming 3 decades. Despite the lessen anticipated payout ratio, the firm’s ROE is not predicted to adjust by significantly.

Summary

On the whole, we do experience that PSC Insurance Team has some optimistic characteristics. Specifically the development in earnings which was backed by an extraordinary ROE. Nonetheless, the high ROE could have been even extra beneficial to buyers experienced the company been reinvesting extra of its income. As highlighted before, the latest reinvestment price seems to be negligible. That getting so, the latest analyst forecasts present that the enterprise will continue to see an expansion in its earnings. To know additional about the firm’s foreseeable future earnings progress forecasts just take a search at this cost-free report on analyst forecasts for the corporation to find out much more.

Have responses on this report? Involved about the articles? Get in contact with us specifically. Alternatively, e-mail editorial-crew (at) simplywallst.com.

This posting by Only Wall St is basic in mother nature. We offer commentary centered on historical knowledge and analyst forecasts only applying an unbiased methodology and our content articles are not intended to be economical information. It does not represent a advice to invest in or provide any stock, and does not consider account of your objectives, or your money scenario. We aim to bring you extensive-term focused assessment driven by essential information. Notice that our examination may not component in the most current price tag-sensitive business announcements or qualitative substance. Simply just Wall St has no position in any stocks outlined.