How To Fix Bad Credit Scores 2023

Table of Contents

What is a Credit Score?

If you don’t know what a credit score is yet, it’s a measure of your overall credit behavior based on metrics scores like credit history, payment history, credit mix, credit utilization rate, and many more. Your credit score is based on information reflected in your account with credit bureaus.

Why is a good Credit Score important?

A good credit score is essential because it allows you more access to cash and extended lines of credit. After all, your credit score increases the lender’s confidence in you being able to repay the money you owe to your creditor religiously. There are business loans for bad credit you can apply for, but it’s better to aim for a good credit score to secure more funding options in the market.

How are Credit Scores calculated?

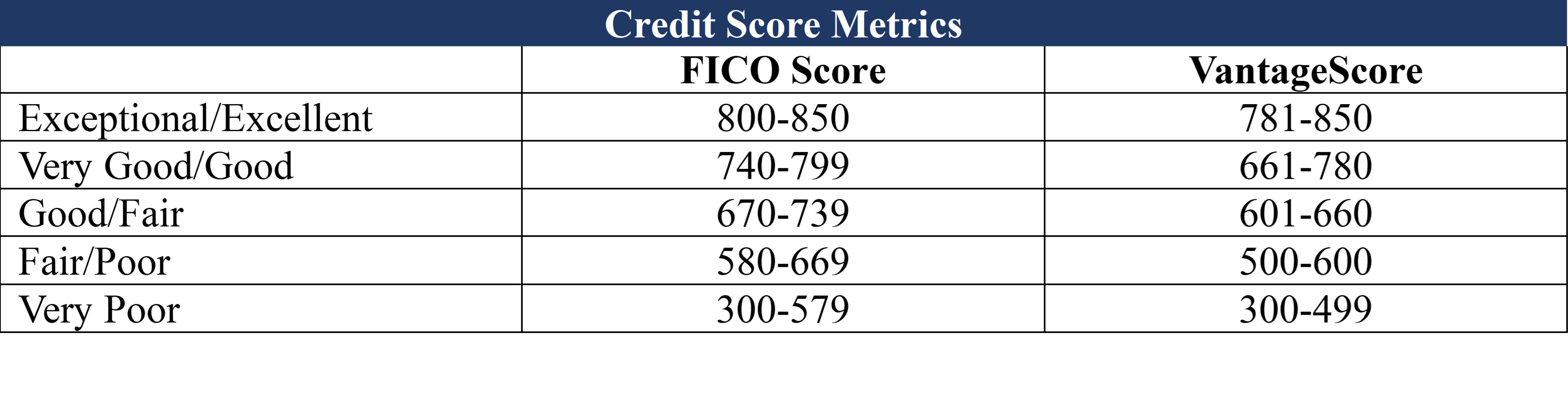

FICO score and VantageScore are different models used to evaluate and rate credit scores. Although different, their ranges aren’t that far off from each other.

Both metrics range from 300 to 850, with 800 to 850 rated as Exceptional with FICO score and 781 to 850 rated as Excellent with VantageScore. Here are the rest of their metrics:

FICO score calculates your credit score with 35% of your credit history, 30% of amounts owed, 15% of the length of credit history, 10% of credit mix, and 10% of new credit.

On the other hand, VantageScore calculates 40% for your payment history, 21% for your depth of credit, 20% for credit utilization, 11% for your account balances, 5% for your recent credit, and 3% for your available credit.

What are some ways to Fix Bad Credit Scores?

Whether you’re building personal or business credit scores, recovering from a bad one, or trying to repair credit scores, here are some ways and practices you can observe to fix and improve your credit score fast:

-

Regularly check credit bureaus

Checking your credit score through credit reports is not difficult, and in fact, you can access them for free!

According to the U.S.A. government website, each individual is entitled to a free annual credit report from the three major consumer credit bureaus: Experian, Equifax, and TransUnion. You can request them from AnnualCreditReport.com as authorized by the U.S. government.

In addition, Experian offers an Experian Boost. This service connects your Experian account with your bank accounts to detect eligible on-time payments to add to your Experian credit report. While results may vary and are not guaranteed, approved payments will immediately add points to your FICO score in real time.

Regularly checking your credit reports yearly (or more) from these major consumer credit bureaus allows you to double-check potential incorrectly reported data that may have negatively affected your credit score.

-

Dispute credit report errors

False or erroneous information reflected in your credit reports aren’t abnormal; they happen way more often than we imagine. If you’re trying for working capital loans with bad credit, not checking and disputing errors and negative information on your credit report is undoubtedly lowering your chances even more.

The most common causes of credit report errors are merchants incorrectly reporting details such as personal information, accounts mistakenly reported on your account due to name similarities, erroneous payment history, inflated balances, and closed and duplicate accounts reported on your account.

A simple and common DIY credit repair method is to dispute errors by submitting a written report to any of these three credit bureaus explaining the erroneous reports before they negatively affect your credit score.

-

Avoid late and default payments

As mentioned above, the most significant factor that affects building business credit is your payment or credit history. Your payment history reflects how often and how much you pay toward your bills and if payments are made on time.

Paying on time

If you’re trying to get fast business loans and creditors see a low credit score and records of several late and missed payments, they are most likely to reconsider extending credit.

Mark Pierce, CEO of Colorado LLC Attorney, says, “While it is true that no one can be arrested just because they’re behind on loan or credit card payments, your creditors can give your information to collecting agents to follow up on your payment.”

He adds, “Late payments and account delinquencies will hit your credit scores the hardest. It is important to double-check your due dates and amount and pay them on time and in full religiously.”

Minimum balance is a scam

Aside from missed payments and late payments, consumers should not be distracted by the term “minimum payments.” Credit card companies say you only need to pay the minimum balance before the due date, but paying the minimum balance does not absolve you from corresponding interest.

Paying the minimum balance saves you from a fixed late payment fee, but interest still incurs from the outstanding balance after your minimum payments. As credit cards are notorious for being high interest debt sources, paying your card in full and on time will save you from extra and unnecessary charges.

Why not try setting up automatic payments on your bank account so you don’t forget to pay your bills?

-

Keep your credit utilization rate low

The credit utilization ratio measures how much of your available credit you’re using. Because credit utilization can take up to 30% of your credit score, keeping your credit utilization rate low means that you are good at managing and paying back your finances, faithfully paying them when they are due.

If you’re trying to be safe, experts say it’s safest to go as low as 10% but never zero. A zero credit utilization rate means that you aren’t making any credit purchases, which isn’t bad but isn’t good, either.

According to Anthony Martin, Founder and CEO of Choice Mutual, “High credit utilization rates usually indicate that an individual or business appropriately manages their finances and does not overspend, making them attractive debtors to extend credit to.”

-

Don’t close old credit card accounts

There are two main reasons why closing an old credit card after eliminating credit card debt is most likely to hit your credit scores badly rather than improve them.

- FICO considers the length of your credit history as the third highest factor in computing credit scores at 15%. The longer you have your credit card balances, the better your credit history looks to creditors, especially when a credit card account is settled regularly without defaults.

- Closing old credit cards lowers your overall credit limit, increasing your credit utilization ratio.

Jerry Han, CMO at PrizeRebel, says, “If you have no choice but to close credit cards with zero balance, choose new ones and those with low credit limits so they don’t significantly affect your credit score.”

-

Don’t make hard inquiries too often

Hard inquiries happen when lenders or credit institutions make credit inquiries to credit bureaus every time you attempt to apply for a new loan, line of credit, or credit card.

While this sounds normal, having hard inquiries reflected on your account too often in a short period is a flag for other creditors that you may have been applying for too many loans and racking up on debt and may not be able to pay because of those records.

A hard inquiry stays on your credit report for two years, while the adverse effects of hard inquiries affect your credit score for only one year. Thus, it is essential to check the list of hard inquiries made on your credit history and make necessary reports to remove hard inquiries in cases where they are incorrectly reported, as they significantly impact your credit score.

-

Seek help from credit repair companies

Credit repair companies are your best friends if you’re having a hard time juggling through all the details of your credit reports or dealing with a credit reporting agency.

What are credit repair companies?

A credit repair company is a team that fixes your poor credit score, primarily by removing inaccurate and negative information from your credit reports. These credit repair companies communicate with the credit reporting agencies on your behalf.

Are these credit repair companies reliable?

While these services sound attractive, they can be pretty costly and tricky. Some agencies are credit repair scams that pose as a credit repair company with the promise of delivering a positive credit history which sounds too good to be true.

Legitimate credit repair services will never ask for an upfront fee. Most of these agencies charge a fixed monthly fee, or after a service is delivered with fees based on a per item basis.

These credit repair companies should never promise to remove these negative reports—a major red flag if they do! If they encourage you to lie to credit bureaus or do illegal activities, stay away from them.

Better yet, you can dispute errors on your own by generating a free credit report from any of the three major credit bureaus.

Credit Repair Company Pros & Cons

Pros:

- Help remove incorrect information from your credit report.

- Advocates with credit card companies on your behalf.

- Can help you develop a credit repair strategy.

Cons:

- It can be costly and tricky.

- Some scam companies pose as legitimate credit repair companies.

-

Consider a debt consolidation loan

Another way to repair credit is by considering a debt consolidation loan.

A debt consolidation loan is a personal loan taken out to pay off all your existing loans in monthly payments. For example, if you have multiple credit card debts, a personal loan for debt consolidation will roll all these outstanding debts into one and give you more leeway to pay these through installment loans.

Remember that a debt consolidation loan does not eliminate your debt, and continuing bad spending habits will more likely make you end up with even more debt.

-

Seek a credit counseling agency

Fixing poor credit is also a battle with the mind, and many people who cannot come to terms with their spending habits are recommended to seek help from a credit counseling agency.

A credit counseling agency houses a nonprofit credit counselor to help you get to the bottom of the ‘Why’ of all your debts—whether you’re spending way more than what you’re earning or already living beyond your means.

While a credit counselor cannot directly help you pay bills, rebuild your credit, or give you a more positive credit history, they will be there to guide budgeting and money management and provide workshops.

-

Consider a Secured Credit Card

A secured credit card requires a cash deposit to guarantee the credit line. Offering the security deposit helps borrowers with bad credit get approved for the card.

Once approved, you can begin making purchases and paying them off to build your credit. Make sure the credit card company reports to the major credit bureaus.

How long does it take to Fix Bad Credit?

Despite following all steps and ways to fix bad credit, your credit score will not magically go higher over a short period. After paying your debts, it would take days for a payment to reflect and weeks for creditors to report such payment to credit bureaus.

Fixing bad credit can take weeks, months, and even years (for the worst cases), as a good credit score is an accumulation of good credit habits over some time.

Most credit financial services companies where you might hold a credit account report to the bureaus on a monthly basis. That means it takes at least one month for positive actions, like making a payment or paying off existing debt, to impact your credit score. It can take several months of positive actions before your score starts to move.

How To Fix Bad Credit Scores – Final Thoughts

Getting a better credit score is a long process of good credit habits, religiously paying your accounts on time and in full, and checking your credit score regularly to make sure that only the credit history that belongs to you is recorded on your account.

There’s no fast lane to repairing bad credit. The best and fastest way to improve your credit score is to start now and be consistent with your habits and practices regarding your finances and accounts.

Contact us if you have more questions on repairing bad credit or want to apply for the best business loans for bad credit. Our loan experts can help you find the best business loan options for your credit score.