Bears fumble on goal line but are still in the game

jpbcpa/iStock through Getty Pictures

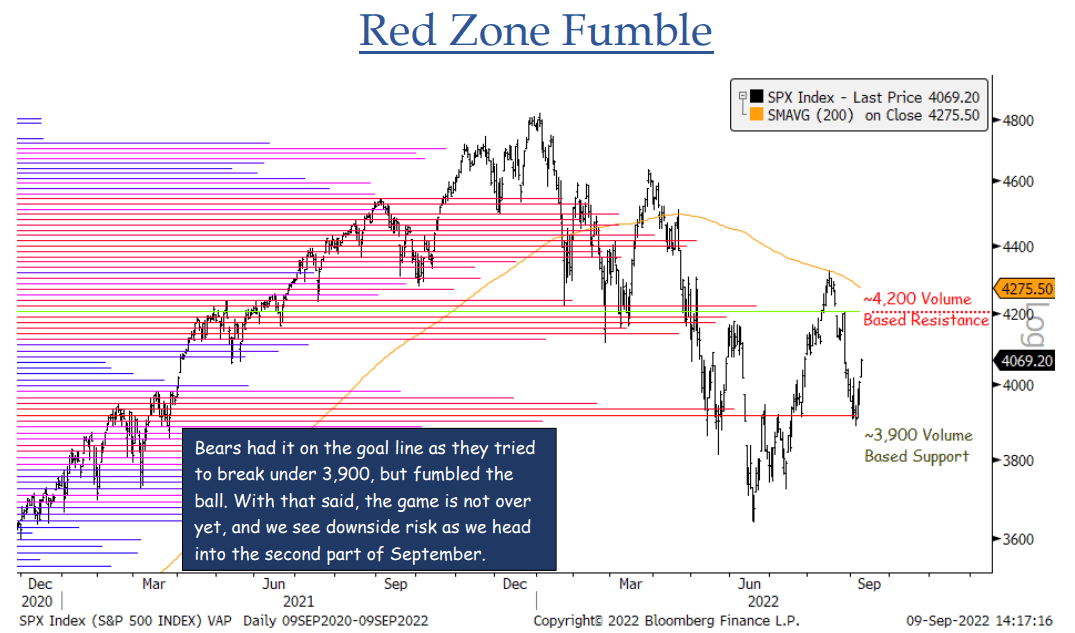

Fairness sellers failed to push the S&P 500 (SP500) (NYSEARCA:SPY) down below the technically crucial 3,900 amount previous week, but it isn’t distinct sailing for extra sector gains, in accordance to Jonathan Krinksy, main current market technician at BTIG.

“Bears fumbled on the aim line as they tried to break below 3,900 very last week, but the recreation is not about still,” Krinsky wrote in his most up-to-date notice. “We see draw back danger as we head into the seasonally weak next element of September.”

“Though the dollar (USDOLLAR) (UUP) and costs paused their ascent, there was no reversal and 10yr (US10Y) (TBT) (TLT) actual rates really shut at contemporary 52wk highs,” he explained. “The SPX place in a bullish engulfing week which can carry some upside into next week, but ultimately we you should not see it functioning absent to the upside right here.”

“Seasonality is just a single section of the puzzle, and under no circumstances to be relied on by by itself,” he included. “With that claimed, on normal the back again fifty percent of September is ordinarily one of the most challenging periods for the market place.”

More than 50% of Russell 3000 (IWV) stocks mounting above their 50-day moving averages would assistance verify a “extra tough uptrend” in shares, in accordance to Krinsky. That measure peaked at 47% in August.

“DXY needs beneath 107 to crack craze, 105 to reverse it,” he stated. “10yr yields require to split less than 3.20%. Serious premiums also suggest the bounce in Nasdaq (COMP.IND) (QQQ) a little bit also optimistic.”

Electrical power shares (XLE) continue to be in a organization uptrend, even with crude oil (CL1:COM) (USO) breaking below $82 per barrel, Krinsky pointed out.

“We are inclined to go with the equities above the commodity and for that reason would stick with some exposure in this article. Uranium (URNM) still a constructive base.”

Is the stock market place experiencing Goldilocks’ evil twin?