A strong market rally could be just weeks away if the U.S. midterm elections can put anxious stock investors at ease

If the U.S. midterm election cycle this yr is like earlier kinds, the stock industry will carve out an important small suitable close to Election Day in November.

That ought to give some hope to beleaguered traders whose inventory holdings have endured double-digit losses so considerably this calendar year. A meaningful rally could be just a handful of weeks absent.

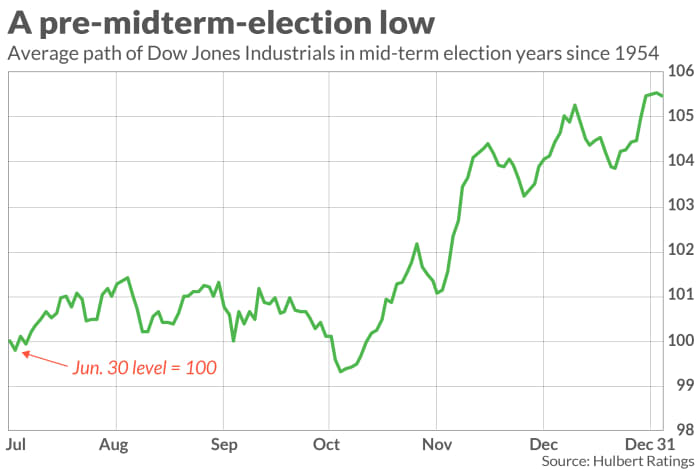

I’m referring to the historical sample in the inventory marketplace of pre-midterm weakness and publish-midterm strength. This pattern is plotted in the chart under, which is based mostly on the common July-December functionality of the Dow Jones Industrial Common

DJIA,

in the past 17 midterm election several years (considering the fact that 1954).

Though the date of the regular in this chart is in Oct, the real lows in the historic report can come previously or later. Significantly depends on when the stock current market starts to anticipate the end result of the midterms and thus special discounts it. A fantastic guess is that the minimal this 12 months will be afterwards, offered the uncertainty about the election result — especially in the U.S. Senate.

It is constantly probable that the pre-midterm very low will occur in progress of Election Working day. It would not be inconsistent with the historic report for this year’s small to have occurred the working day after Labor Working day, in simple fact. As of Sept. 9, the S&P 500

SPX,

was more than 4% greater than that minimal.

It’s value noting how impressive it is for any sample to emerge when averaging alongside one another numerous yrs really worth of stock marketplace gyrations. However each and every 12 months carves out a unique route, the highs and lows usually cancel each individual other out, leaving the average to be a gradual upward-sloping line. A sample has to be pretty pronounced in the historical details for a deviation to show up that is as stark as the a single in the accompanying chart.

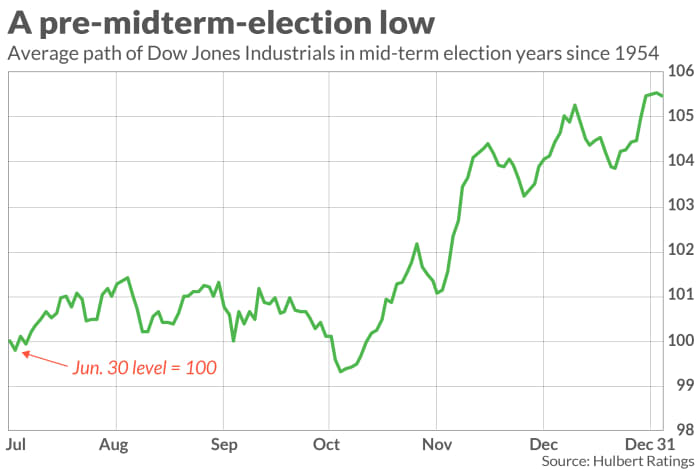

This pre- and article-midterm sample is so pronounced that it is the supply of the renowned seasonal pattern regarded as the “Halloween Indicator,” in accordance to which the inventory industry is strongest involving Oct. 31 and May well 1 and weakest the other 6 months of the calendar year. Still just take away the 6 months prior to- and right after mid-phrase elections and the Halloween Indicator disappears.

The underlying facts appear in the table under. The cell marked with a solitary asterisk (*) refers to the current six-thirty day period time period, even though the cell marked with a double asterisk (**) corresponds to the six-month interval that starts at the finish of Oct 2022.

| Calendar year of Presidential cycle given that 1954 | Ordinary Dow gain from Halloween to May 1 | Regular Dow attain from Might 1 through Halloween |

| 1 | 6.4% | 1.5% |

| 2 | 4.7% | -.2%* |

| 3 | 15.1%** | 1.1% |

| 4 | 4.3% | .5% |

So if you are tempted to bet on the Halloween Indicator, your time is fast approaching. If you overlook it, you won’t have a different probability right until the 2026 midterms.

Credit score for getting that the Halloween Indicator traces to the months prior to and subsequent to the midterms goes to Terry Marsh, an emeritus finance professor at the University of California, Berkeley, and CEO of Quantal International, and Kam Fong Chan, a senior lecturer in finance at the College of Queensland in Australia. Their study into this sample appeared in July 2021 in the Journal of Economical Economics.

The probable resource of the sample, according to the researchers, is the uncertainty that exists prior to the midterms and the resolution of that uncertainty following the election. They observe that it seems not to subject which bash dominates Congress prior to the midterms and which becomes the the vast majority occasion afterwards. The sample exists, they imagine, for the reason that the inventory market place craves certainty, even when the supply of that certainty may well not be in accord with every single investor’s political tastes.

Mark Hulbert is a frequent contributor to MarketWatch. His Hulbert Ratings tracks financial commitment newsletters that shell out a flat payment to be audited. He can be arrived at at [email protected]

Extra: Big traders are favoring significant-cap stocks for the rest of 2022 — perhaps you should really much too