10 Best No Credit Check Loans and Bad Credit Loans with Guaranteed Approval Online

Table of Contents

Getting approved for a personal loan can be difficult if you have bad credit. Most banks don’t want to lend money to people with poor credit scores due to the high risks involved. Luckily, there are still a few options available for people with bad credit – like no credit check loans, for instance.

Remember that “no credit check” doesn’t mean there won’t be any credit check at all. It simply means that there won’t be a hard credit inquiry, which means no impact on your credit score, and your credit history won’t be a big factor in whether or not you’re approved. Although there’s no such thing as no credit check loans guaranteed approval, these loans are definitely easier to qualify for with more manageable requirements and higher –than –usual approval rates.

Let’s take a look at them here.

- WeLoans – Our best website choice if you want to get easy and reliable no credit check loans.

- CocoLoan – This online platform is for you if you need bad credit loans released on the same day.

- US Bad Credit Loans – True to its name, this platform is friendly to borrowers with bad to no credit.

- iPaydayLoans – This site specializes in payday lohttps://weloans.com/loans-for-bad-credit/no-credit-check?source1=reviewjournal&source2=no-credit-check-loansans and accepts even those with terrible credit backgrounds.

10 Best No Credit Check Loan Sites

1. WeLoans

If you’re looking for a website that offers no credit check loans, look no further than WeLoans. It’s a reputable online broker that can help connect you to an entire network of partner lenders, regardless of your credit history.

What’s great about WeLoans is that they offer a wide range of no credit check loans, from personal to business loans. They also offer urgent loans that can be released within the same day, so they’re perfect for those who need money right away. Most loans you can get through WeLoans are easy to apply for with bad credit-friendly conditions and instant approval available.

You can request a range of loan amounts through WeLoans, from $50 to a whopping $35,000 if you have an outstanding credit background. All you have to do is submit the necessary information and documents, which they will forward to their lender network. No matter what type of loan you’re looking for, they can probably help you out.

That said, WeLoans doesn’t display the APR ranges of their lenders. This is pretty inconvenient since it’s always good to know the interest rates and other fees before taking out a loan.

Pros

- Fast response times

- Bad credit friendly

- Quick and easy application process

Cons

Fast Cash for Bad Credit or No Credit on WeLoans! Take a Look Now!

2. CocoLoan

CocoLoan is another great website to get no credit check loans. They’re an online lending platform that can help connect you to their network of 200+ direct lenders.

Not to mention, CocoLoan is not strict at all. As long as you’re at least 18 years old and have a valid and regular income, you can apply for a loan, of which they have plenty. They offer personal loans, bad credit installment loans, payday loans, no credit check loans, and their specialty: quick loans.

The amount you can get from CocoLoan can go as high as $5,000 for a payday or same-day loan and $35,000 for a personal loan. As mentioned above, you can quickly get a same-day payday loan with no credit check as long as you meet the basic requirements.

The best part about CocoLoan is that they offer a 100% online application process. You can quickly fill out the form and submit it in just a few minutes. Plus, they have a pretty fast response time.

The biggest downside is that they’re not available in all states yet, so you must check the availability before submitting any information to them.

Pros

- Offers up to $5,000 for a no credit check loan

- Lots of reputable lenders in their network

- Fast loan application

Cons

- Not available in all states

- Not transparent with fees

Visit CocoLoan Today to Get No Credit Check Quick Loans!

3. US Bad Credit Loans

US Bad Credit Loans is an online lending platform that connects you to lenders who grant no credit check loans to all sorts of people, regardless of their credit score.

Similar to the two sites above, the lenders in the US Bad Credit Loans network don’t have stringent requirements for their borrowers. If you can fulfill the basic requirements, such as being above 18 years of age and having a stable source of income and a government-issued ID, you’re free to send your request to US Bad Credit Loans.

They will then forward your data to hundreds of their partner lenders, who will review your information and send you offers once they’re done assessing your profile. With US Bad Credit Loans, convenience and speed take top priority. In fact, the entire process can be done in as fast as 15 minutes.

US Bad Credit Loans can offer no credit check loans up to $5,000 to people with bad credit. The only disadvantage to using this platform is that they don’t show their lenders’ APR ranges on their website.

Pros

- Extremely bad credit friendly

- Hundreds of partner lenders are available

- The entire process can take as little as 15 minutes

Cons

- It doesn’t show APR rates on the website

Get Fast No Credit Check Loans for Bad Credit by Visiting Us Bad Credit Loans Now!

4. iPaydayLoans

Payday loans are one of the most popular types of loans among people with bad credit. If you’re in dire need of cash and don’t have time to wait for a traditional bank loan to go through, then a no credit check payday loan might be the best solution.

iPaydayLoans is one of the best places to get a no credit check payday loan. They’re an online lending platform that helps connect you to their network of direct lenders without all the strict requirements required by banks. They also offer other types of loans, such as installment loans, bad credit loans, personal loans, short-term loans, and title loans.

However, it’s important to note that many lenders at iPaydayLoans may still do a soft credit check due to financial regulations. This won’t affect your credit score, though.

Pros

- Offers various types of loans

- Doesn’t do hard credit checks

- Hundreds of partner lenders

Cons

- Most loan offers with high APR rates

Get Easy Loans Online Without Credit Checks by Using iPaydayLoans!

5. Fast Title Loans

Although Fast Title Loans focuses on title loans, they do offer other types of no credit check loans for bad credit, including quick loans, bad credit payday loans, and personal loans.

As collateral, they accept car titles, boat titles, and even motorcycle titles. For these types of loans, the loan amount will typically depend on the value of your vehicle title, which means the current market value of your vehicle if it’s already paid off or the equity that you have on it if it’s not yet fully paid. These secured loans can go as high as $35,000 without hard credit checks.

You can get anywhere from $50 to $5,000 just by meeting the basic requirements for no credit check loans. After submitting your request, you may get approved instantly and receive your funds as fast as the next business day.

Unfortunately, Fast Title Loans suffers from the same problem that the other sites on this list have: no APR ranges on their website.

Pros

- Offers different types of loans

- Bad credit friendly

Cons

- APRs are not shown clearly on the website

Visit Fast Title Loans and Get No Credit Check Loans for Bad Credit Today!

6. US Installment Loans

US Installment Loans is an online broker platform specializing in various no credit check installment loans such as title loans, same-day payday loans, and personal loans. These are loans that are typically paid back in fixed monthly payments, making them more manageable and predictable than other types of loans. They’re particularly helpful for people with bad to no credit.

The loan amount that you can get will depend on the type of loan that you choose. You can submit payday or same-day loan requests for up to $5,000. You can also can request an amount for your personal loan as high as $35,000. However, the actual amount you will receive still depends on your specific lender and your financial situation.

The entire process is quick and easy, and you can receive your funds within 24 hours. One thing that makes US Installment Loans stand out is their online knowledge base. They have plenty of resources regarding their services, loans, and other financial knowledge.

Pros

- Offers various loan types

- Has an entire network of partner lenders

- Provides information and resources

Cons

- No APR ranges on the website

- May have to pay high-interest rates

Visit Us Installment Loans Now to Get Easy Approval No Credit Check Installment Loans!

7. US Title Loans

US Title Loans is an online lending platform offering no credit check loans for people with bad credit, including title loans, payday loans, and personal loans. You can also can use their online platform to locate nearby title loans and cash advances.

Their partner lenders don’t charge high upfront fees, so you can be sure you’re getting a fair deal. The maximum loan amount will depend on the type of loan. If you need to get a no-hard check payday loan with bad credit, you can expect up to $5,000. On the other hand, those with a good credit score can request a higher amount of personal loan, up to $35,000.

Pros

- Offers different types of loans

- Bad credit friendly

Cons

- No APR ranges on their website

Visit Us Title Loans and Get Started With Your No Credit Check Loans Today!

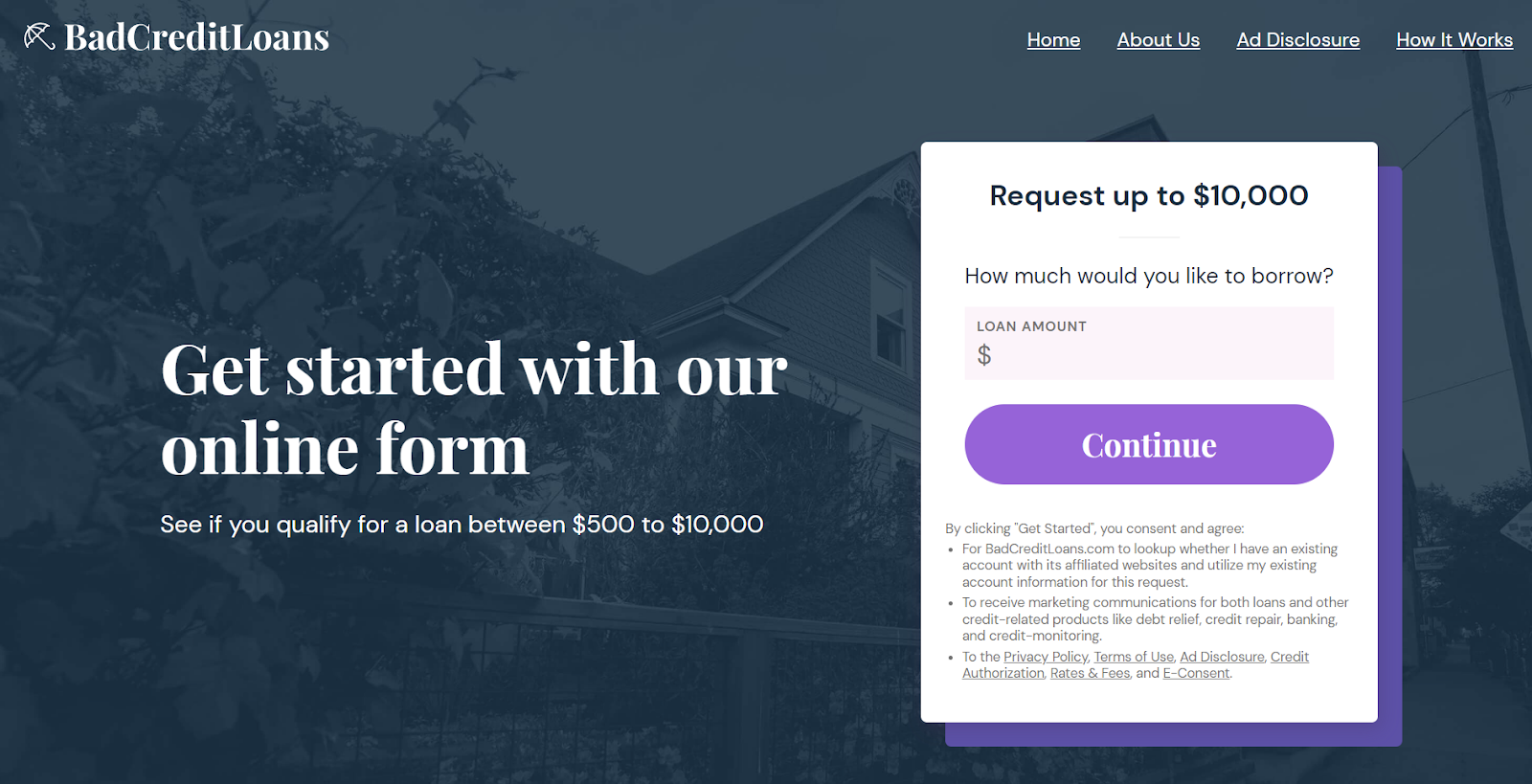

8. BadCreditLoans

As the name implies, BadCreditLoans is an online lending broker that caters specifically to people with bad credit.

Depending on the specific lender, borrowers can get anywhere from $500 to $10,000. This site is one of the few that show APR ranges, which can be as low as 5.99% to 35.99%. The repayment terms also differ, typically 3three to 72 months.

BadCreditLoans has a network of over a hundred100 different lenders, so you’re sure to find one right for you. The entire process is quick and easy, and you can get your funds as fast as 24 hours.

Additionally, BadCreditLoans’ website has plenty of online resources for you to further your financial knowledge. Many of their articles focus on helping people avoid scams, which could further damage their credit score.

Not to mention, if you’re not eligible for a loan, BadCreditLoans also provides other financial solutions such as debt relief or credit repair services to help you out.

Pros

- It caters specifically to people with bad credit

- Has a network of over 100 different lenders

- Shows APR ranges on the website

Cons

- Max loan amount is relatively low

Visit BadCreditLoans Now for Bad Credit-Friendly Loans with No Credit Checks!

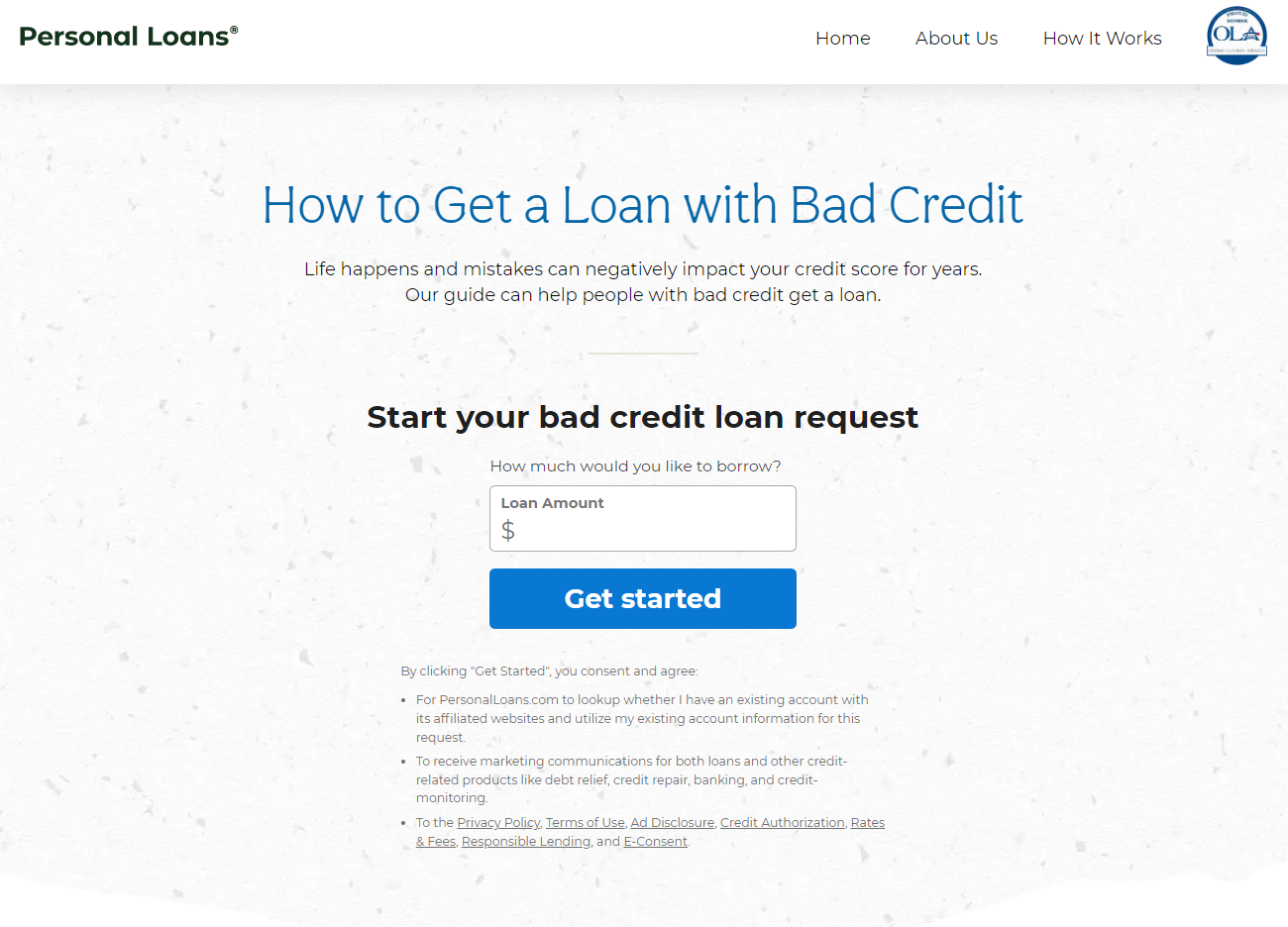

9. PersonalLoans

PersonalLoans is another online lending site that offers personal installment loans with no hard credit check. You can get anywhere from $100 to $35,000, although they may have to make a hard inquiry to approve higher amounts.

This platform is a free brokering site, so you won’t have to pay anything to connect you with their network of lenders. If they can’t match you with a particular lender, they can also can connect you to other non-lender services, such as credit repair and debt assistance.

Lenders on this platform have some of the best terms available, offering a repayment period of anywhere from 90 days to 6six years at a minimum APR of 5.99% and a maximum APR of 35.99%.

The biggest downside to this platform is that they can’t guarantee how third parties may use your data. Additionally, they get compensated for marketing other services and products and sharing information with third parties.

Lastly, since PersonalLoans charges their partner lenders, your loan may have an additional charge to it called an origination fee.

Pros

- High loanable amount

- Long repayment period

- Shows APR ranges

Cons

- You may be charged an origination fee

- May conduct hard credit inquiries for higher loan amount requests

Try Out PersonalLoans Today to Get No Credit Check Personal Loans With Bad Credit!

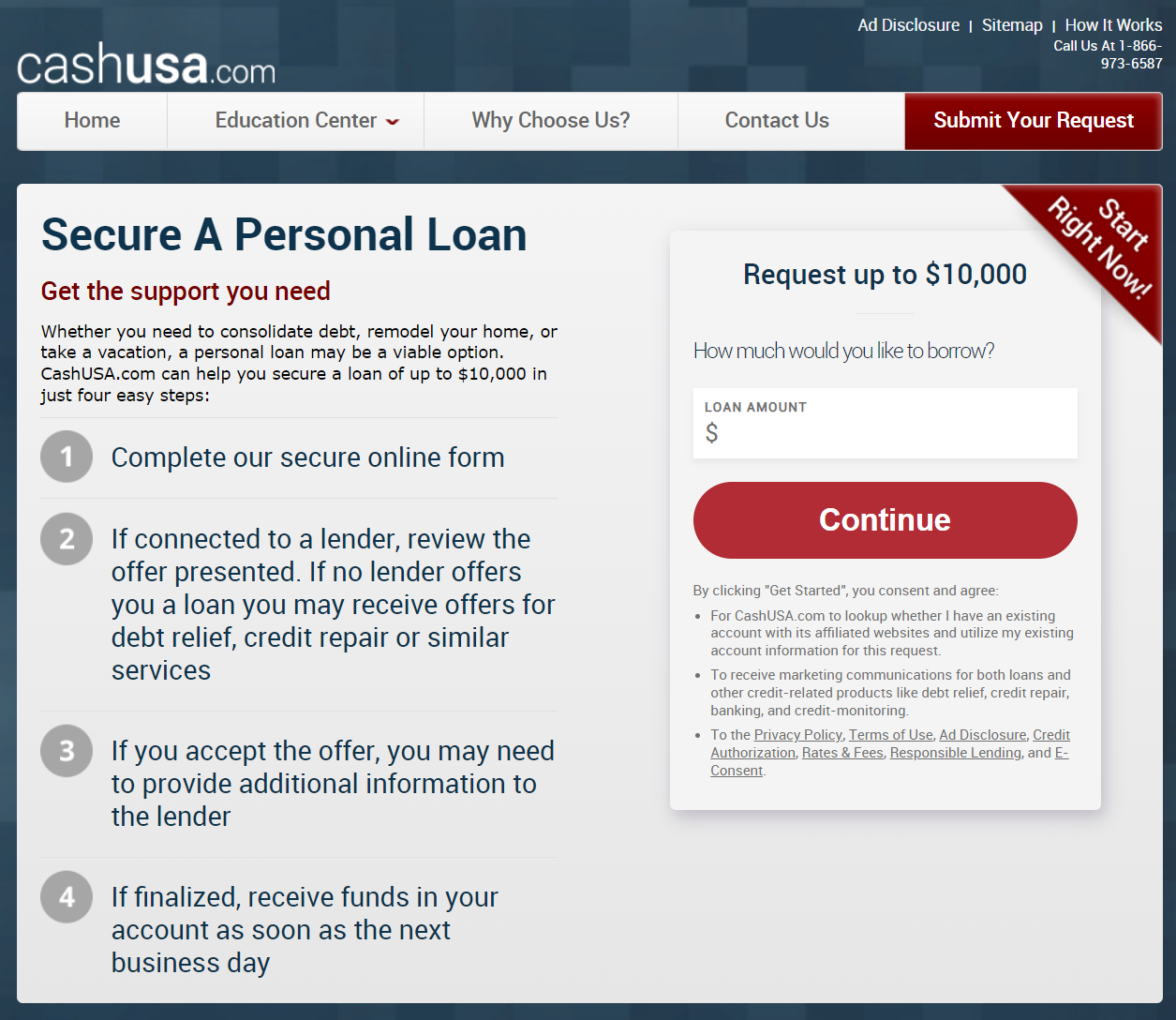

10. CashUSA

CashUSA is an online broker with a vast network of lenders that offer personal loans to people with bad credit. Borrowers can get up to $10,000 for a variety of purposes.

Interestingly, CashUSA turns every single loan on their site into an installment loan, which means that no matter what kind of loan you get, you can pay it back in installments, easing the burden and hassle.

Some lenders on the site even accept scheduled payments, so you won’t have to worry about paying your loan manually. If you’re going through a rough patch in life right now and need to get a personal loan despite your bad credit, CashUSA is for you.

However, as of this writing, CashUSA isn’t available in all states yet, so be sure to check first.

Pros

- Automatic installment loans

- Flexible repayment periods

Cons

- Not available in some states

For Installment Loans That You Can Get Today Without Hard Credit Checks, Visit CashUSA!

FAQs

Is It Possible to Get Loans Without Credit Checks?

Getting loans without credit checks is difficult because most lenders require some credit assessment to assess the applicant’s repayment ability. However, a few lenders are willing to provide loans without conducting a hard credit inquiry. These lenders typically offer small loans with high-interest rates and may require collateral.

What Will Happen to My Credit Score if I Get a No Credit Check Loan?

If you want a no credit check loan, lenders will likely conduct a soft credit inquiry to assess your creditworthiness. Soft inquiries do not affect your credit score, but hard inquiries can lower your credit score and reflect on your credit report.

In long-term consideration, repaying your loans as well as paying your regular bills will gradually increase your credit score over time. Just like traditional creditors, most online lenders will submit the applicant’s repayment activities to the credit bureau, and the result will sync to your credit report.

How Long Does It Take To Get My Fund When Getting Online No Credit Check Loans?

The time it takes to get your funds when getting online no credit check loans varies by lender. If your documents and information are proven reliable with verified repayment ability, the time it takes for lenders to make approval decisions is usually faster. Some lenders may deposit your funds as soon as the same day you apply, while others may take a few days to process your application due to additional assessments involved or banking system delays.

Members of the editorial and news staff of the Las Vegas Review-Journal were not involved in the creation of this content.