UK’s Liz Truss will unleash billions of pounds to help with energy bills

Table of Contents

The U.K.’s recently elected primary minister Liz Truss is expected to announce a multi-billion-pound stimulus offer to assist persons with soaring vitality charges.

Carl Court docket / Personnel / Getty Photographs

LONDON — The U.K.’s new Primary Minister Liz Truss is established to announce a package deal well worth tens of billions of kilos to assistance people to pay back their vitality payments on Thursday, but there are considerations in excess of how it will be funded.

The coverage announcement is predicted to freeze the selling price of vitality both at its present-day amount or at £2,500 ($2,870). As it at present stands the cap coming into effect next thirty day period will raise the regular energy monthly bill from £1,971 to £3,549 a 12 months.

Truss mentioned she would “offer with the energy disaster induced by Putin’s war” in her maiden speech as prime minister on Tuesday night. “I will take action this week to offer with electricity charges and to safe our long term power supply,” she mentioned.

The announcement is set to occur as much more than 170,000 people today in the U.K. prepare to terminate their electricity bill payments on Oct. 1 in protest in opposition to the amplified vitality selling price cap.

The number of men and women in fuel poverty in Britain, defined as staying unable to adequately warmth a household, will strike 12 million homes (42%) this winter season if economical guidance isn’t really set in area, according to the Conclusion Gasoline Poverty Coalition campaign team.

£180 billion really worth of support?

The specific specifics of the bundle have nevertheless to be unveiled. Initial projections recommended it may possibly be around £100 billion really worth of assistance, but the latest estimates from Deutsche Lender mentioned it could be nearer to £200 billion.

The Bank hiked up its expectations as reports recommended an vitality bill freeze would sit at all over the £2,500 stage, which was “a significantly lower volume” than the lender had predicted, it said in a investigate be aware Wednesday.

Studies also recommend a £40 billion bundle will be put in position to help organizations with their vitality prices, according to the lender, bringing the overall of the expected assistance actions to £180 billion.

It was initially predicted that support would only be accessible to homes.

The figure is virtually half as much as was used on offering economical help all through the Covid-19 pandemic and just about 8% of gross domestic merchandise, in accordance to Deutsche Bank. It estimates the freeze will be in position from Oct.

‘Bill will eventually slide on taxpayers’

The deal established to be declared by Truss might not be much too dissimilar to a system proposed by the opposition Labour Occasion on Aug. 14.

The most important variance is that Labour experienced recommended funding the transfer by a windfall tax on oil and gasoline firms — something the new prime minister has ruled out.

“I am towards a windfall tax,” Truss advised the Dwelling of Commons throughout her initially questioning session with fellow lawmakers on Wednesday.

“I imagine it is the mistaken factor to be placing firms off investing in the United Kingdom just as we have to have to be developing the economic climate,” she explained.

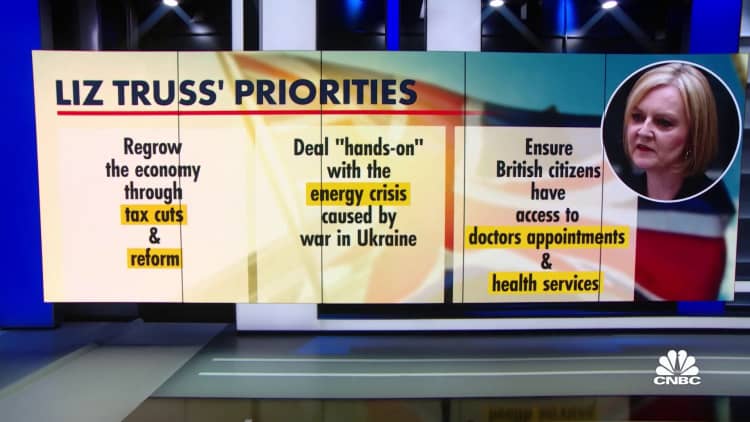

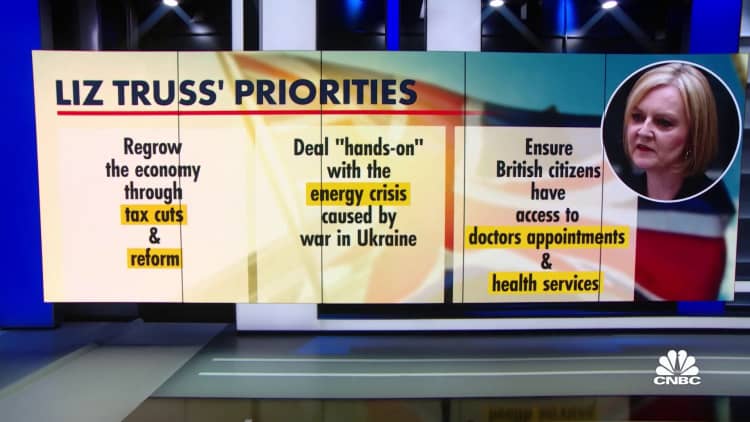

Rising the U.K. overall economy through “tax cuts and reform” was one particular of 3 vital mandates laid out by the new prime minister in her first speech Tuesday evening.

The others have been tackling the strength crisis and improving upon Britain’s Nationwide Health Assistance.

The new electrical power package deal will possible be funded by way of further govt borrowing but the aftermath of the monetary aid could be felt for decades to occur, according to Christopher Dembik, head of macro examination at Saxo Lender.

“She will have to abide by only 1 path: opening up the doorway for a enormous stimulus offer and, once the disaster is settled, increasing taxation,” Dembik mentioned.

“It is great news for the small expression, even though the monthly bill will sooner or later drop on taxpayers in the prolonged operate and could just take generations to pay off,” he told CNBC.

‘It’ll do practically nothing to aid us in the winters to come’

An strength stimulus bundle would be a quick-expression alternative to a extended-phrase dilemma for people in Britain, in accordance to economist Jeevun Sandher.

“The prepare as it is currently stated would stop the catastrophe coming but the disaster still exists,” he explained, referencing the price tag-of-residing disaster already impacting many people and businesses in Britain.

“This vitality price tag freeze may possibly stop that disaster coming this winter season, but it will do practically nothing to help us in the winters to occur,” he explained.

The gasoline sector may perhaps also come to feel the knock-on results of a stimulus offer, reported Salomon Fiedler, an economist for expenditure financial institution Berenberg.

“If incumbent utility companies freeze charges now but independently continue to keep them earlier mentioned costs in the upcoming, they could be outcompeted by new entrants in the upcoming which do not have to recuperate present-day losses and hence could undercut them,” Fiedler reported.

“A further difficulty is that a normal strength price freeze would remove incentives to lower fuel usage for households,” Fiedler advised CNBC. “This very likely will make the plan extremely high priced and maximize the scarcity of fuel for sectors not covered by the freeze even additional.”

There is also speculation as to the affect on the overall economy as a total. Even though Truss’ low-tax and deregulation procedures might bolster the financial system, the advantages will not be felt for a number of years, or even decades, Fiedler reported.

“In the small run, extra fiscal stimulus, be it through tax cuts or support actions, would exacerbate inflation pressures (even as documented inflation costs will rely on the facts of these measures) if they are not financed by … spending cuts somewhere else,” he wrote.

The price tag of electrical power expenditures “is definitely the most critical challenge to voters appropriate now,” Chris Curtis, head of political polling at Opinium Investigate. explained to CNBC.

“It really is critical as a new key minister to make a good to start with perception and Liz Truss is hoping that by having a massive intervention on voters’ biggest precedence, it really is likely to go some way to generating that constructive initial impression,” Curtis said.

“Most voters inform us that they however really don’t know really considerably about her and views of her are pretty weak, so it is a definitely significant instant for her to check out and land well with the community,” he reported.

‘Impossible challenges’ for the most susceptible

With warnings that the next decade of winters could be “horrible” if severe action isn’t really taken to management fuel price ranges, some are inquiring if the approaching deal will be more than enough to safeguard the most vulnerable.

Freezing charges at their latest stage would induce electrical power desires to spike and worsen the condition, according to a investigate take note from Sarah Coles, senior particular finance analyst at Hargreaves Lansdown.

“Whilst any individual shelling out with a direct debit will technically presently be spreading increased costs all over the 12 months, individuals on lessen incomes are additional probably to be on prepayment meters, the place they pay for the electricity they use at the time they use it,” Coles explained.

“If costs are frozen at a a little larger stage it will compound the impossible issues struggling with the most susceptible this wintertime,” she claimed.