Stock market may be facing Goldilocks’ evil twin (NYSEARCA:SPY)

Watcom

Traders could be experiencing the polar opposite of the Goldilocks situation of just-proper problems, according to Leuthold Team CIO Doug Ramsey.

“No way too incredibly hot and not also cold? What about both equally?” Ramsey wrote in a take note (emphasis his).

“Work progress and inflation are hot adequate to for the Fed to adhere to through with its on its hawkish promises,” he claimed. “But the leading indicators keep on to alert us of oncoming cold. The odds are that the porridge settles at the suitable temperature, without having an intervening economic downturn, seem for a longer period by the day.”

Although the greatest extensive-term entry details to the inventory market were to be experienced in terrible economies, that took place when the complications have been priced in, Ramsey claimed.

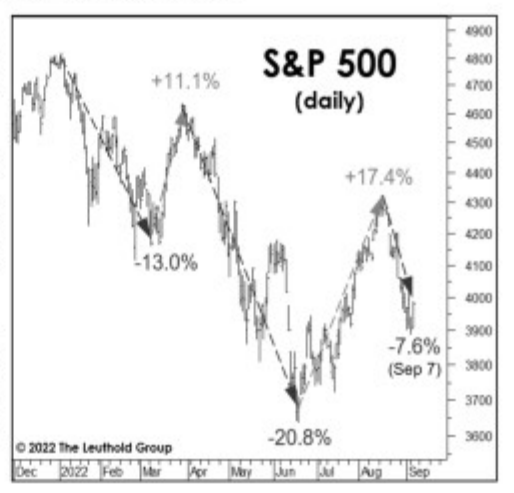

In 1990 a 20% drop in the S&P 500 (SP500) (NYSEARCA:SPY) coincided with raging inflation and a dip in main indicators “and a stunning bull was born,” not in 2022, he reported.

“Cash is restricted and the tape has rolled more than, nevertheless valuations trade near their pre-COVID highs.”

“At some phase in the bear industry, we will go to where ‘bad news is very good news,'” he additional. “But in conditions of selling price that is likely at the very least a couple of hundred S&P points beneath present ranges.”

The S&P closed at 4,067 on Friday.

“The problem of time is additional complicated due to the fact of the unpredictable lags involved with the Foremost Financial Indicators.”

BofA says the excellent news for bulls is that stocks are still keeping up about bonds.